If you’re not certain that you are able to the necessary repayments, then it was better to waiting and you will reassess the choices.

- Whenever do you need the task done? If not must do the latest improvements instantly, it may be worthy of prepared and you may preserving right up some funds so you can loans region, otherwise all of the, of your functions. Prepared before you take out that loan could also enables you to replace your credit history and you may improve your chances of providing an effective loan which have a diminished interest.

- How much does the job costs? Make sure you get several prices to suit your home improvements you never spend more-the-potential which means you understand how much you need to acquire. You ought to merely borrow extent you desire and never capture away a more impressive financing simply because you are qualified.

- Look at the business you will employ is actually credible and you may entered to complete the mandatory performs. In order to minimise the possibility of difficulties in the future which will end costing you a great deal more currency, make sure you carefully browse firms to ensure that they’re accredited to-do the task.

- Just how much are you willing to be able to pay off each month? You ought to workout a funds to see what you are able conveniently afford to pay. This will help you observe far you could potentially acquire and just how long you will want to generate money. However,, this new lengthened the expression, the greater number of you likely will shell out in attract total.

- Maybe you’ve opposed loan providers? payday loan Petrey It is better to compare some other loan providers so you can find the best financing for the state. It is possible to play with a qualification provider that appears on numerous lenders to see just what funds you can be eligible for.

- Have you thought about choices so you’re able to financing? Taking out a loan to pay for home improvements might only both be the best solution. There are many types of investment that you might consider alternatively regarding that loan, such as for instance a credit card.

- Will you be improving your house’s energy savings? In that case, you may be able to find that loan that have a lesser rates or perhaps be entitled to financing from your own opportunity vendor otherwise regional council, such.

Relatives and buddies

When you have any nearest and dearest or friends that will manage in order to give you some cash, it could be value inquiring all of them for a loan. However,, while this shall be a less expensive solution than simply taking out fully an excellent official financing, its not a decision that needs to be taken gently.

You have to know the latest impact the mortgage have on your own matchmaking and you may exactly what could happen in the event the one thing don’t work aside. Placing the loan agreement in writing, such as the regards to fees and what will happen if you fail to pay the mortgage, can also be reduce the chances of some thing going incorrect subsequently.

Definitely just use regarding someone you know and you may believe. Be wary if someone else gives you financing because they could end up being an unlawful loan-shark.

Handmade cards

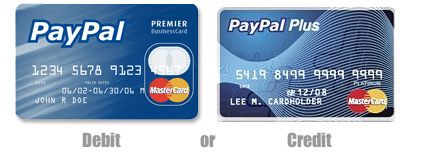

For folks who only need to borrow a small amount to possess an effective short amount of time, you might consider using a charge card to finance the desired performs.

There are various credit card providers offering lower or 0% attract episodes towards commands otherwise balance transfers but be mindful of the offer end dates due to the fact, for many who continue to have a great personal debt in your card following this big date, you’ll be able to wind up using significantly more interest than you might on the an elementary financing.

Remortgaging

If you’d like to obtain a larger amount along with home financing on your domestic, you may consider remortgaging.